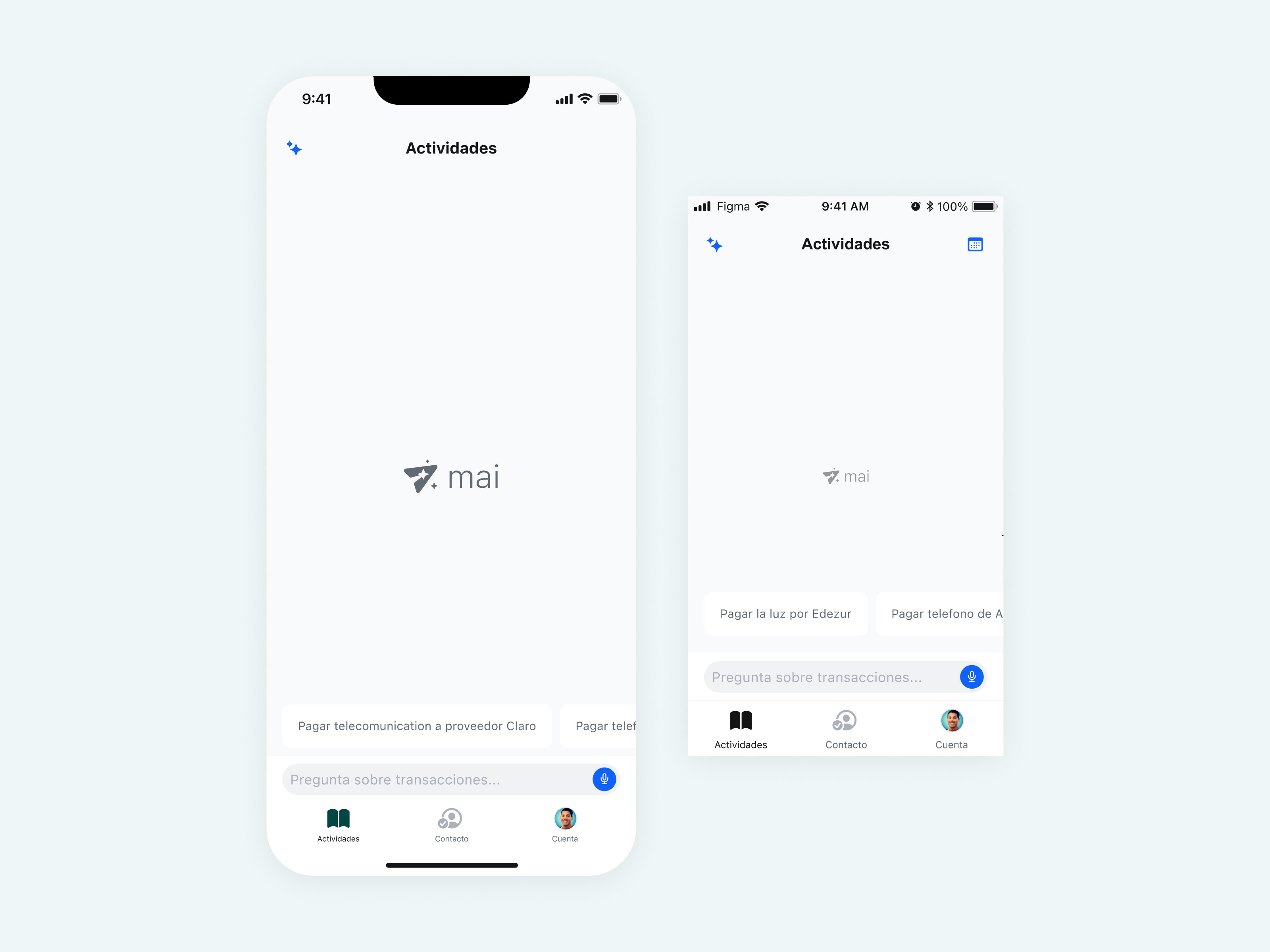

Empowering financial inclusion in the Dominican Republic through secure, contactless payments.

Overview

In 2021, our team identified a critical issue in the Dominican Republic—55% of the population lacked access to banking, hindering online transactions and digital financial management. To address this, we developed a Spanish-language mobile app for secure, contactless payments.

Industry

Fintech

Disciplines

User Research Visual Design Interaction Design Product Strategy

Team

Date

2022

The challenge

Amidst the COVID-19 pandemic, the absence of banking services in the Dominican Republic posed significant hurdles. With safety concerns tied to high crime rates and job loss, our challenge was clear: provide a secure and accessible alternative to physical cash transactions, empowering the population with digital financial tools.

The solution

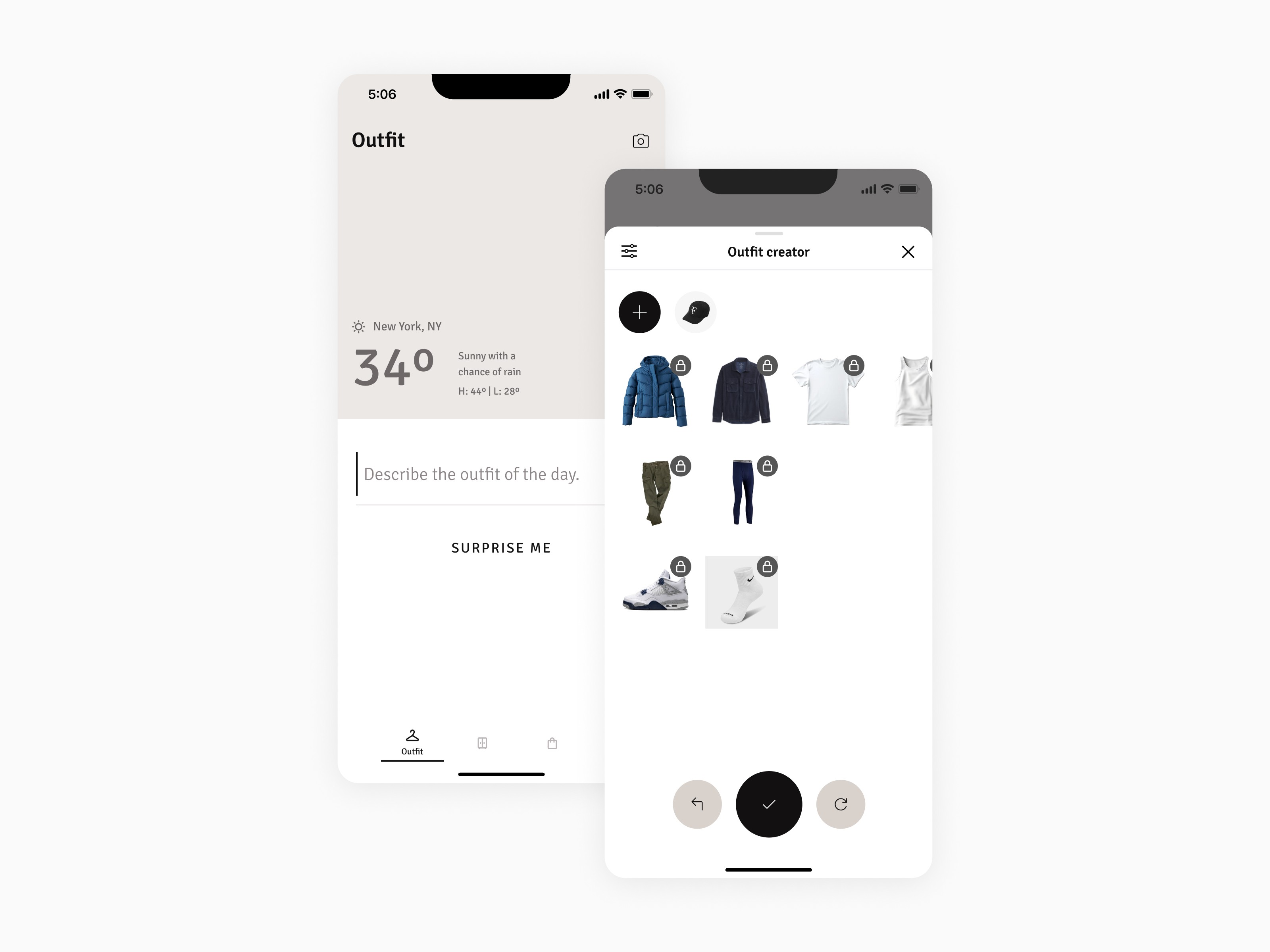

Our team responded to the banking access challenge in the Dominican Republic by creating a user-friendly mobile app. Conducted ethnographic research and design sprints to test and validate the product in the Dominican Republic. This app facilitates secure and contactless payments, empowering users to navigate online transactions and manage their finances digitally. The solution not only bridges the gap in banking services but also addresses safety concerns associated with physical cash, providing a safer and more convenient alternative in the face of economic uncertainties heightened by the COVID-19 pandemic. The app, offered in Spanish, aligns with regional linguistic preferences, ensuring broad accessibility and usability among the target population.

Results

One of the key achievements of the project was the successful resolution of equitable design challenges faced by Non-Banking Units (NBUs) within the LATAM market. This endeavor required a deep dive into the unique complexities of the region, taking into account cultural nuances, economic variations, and diverse user demographics. Through a combination of user research, empathy-building exercises, and iterative design sprints, we were able to tailor solutions that not only addressed the specific needs of NBUs but also upheld principles of equity and inclusivity. Our approach to solving equitable design problems involved a multidisciplinary collaboration, bringing together professionals with diverse backgrounds and skill sets. This allowed us to consider a broad spectrum of perspectives, fostering creativity and innovation in our solutions. Moreover, we implemented a user-centric design thinking framework, ensuring that the end results were not only operationally effective but also resonated with the users on a human level. Overall, the Moneda project not only provided valuable insights into running design sprints in person with real users but also demonstrated our ability to tackle complex and equitable design challenges in the dynamic landscape of the LATAM market. The portfolio result showcases a comprehensive and thoughtful approach that combines practical methodologies with a deep understanding of the local context, ultimately contributing to the creation of impactful and inclusive solutions for NBUs in the region.